deceased taxpayer goes at the top of Form 1310." width="1528" height="552" />

deceased taxpayer goes at the top of Form 1310." width="1528" height="552" />Let’s begin with a step by step guide of how to complete this tax form.

Let’s begin by walking through Form 1310, step by step.

In this section, we’ll go through each part of the form, step by step. That way, you’ll have a better understanding of how to complete the form.

There are 3 parts to this form, not including the taxpayer information fields at the top:

Let’s start with the taxpayer information first.

In this section, we’ll go through each information field to provide the IRS information about the decedent and the person claiming the tax refund on the decedent’s behalf. Let’s begin at the top.

Most individual taxpayers file tax returns in which the taxable year and calendar year are identical. In these cases, simply enter the calendar year of the final tax return.

If the decedent was a fiscal year taxpayer, enter the beginning and ending dates of the most recent fiscal year for which the final return was filed.

Enter the name of the decedent here. In the case that the refund is for a joint return, and both taxpayers are deceased, then you would do the following:

Enter the decedent’s death as shown on his or her death certificate.

Enter the SSN of the deceased.

Enter the name of the person who is claiming the deceased taxpayer’s tax refund.

deceased taxpayer goes at the top of Form 1310." width="1528" height="552" />

deceased taxpayer goes at the top of Form 1310." width="1528" height="552" />

Enter the claimant’s SSN.

Enter the home address for the claimant. Enter a PO Box in the address fields only if the United States Postal Service (USPS) does not deliver mail to your home address.

Enter the claimant’s city, state, and zip code.

If your address is outside the United States or its possessions or territories, enter the information in the following order:

Follow the country’s practice for entering the postal code. Do not abbreviate the country name.

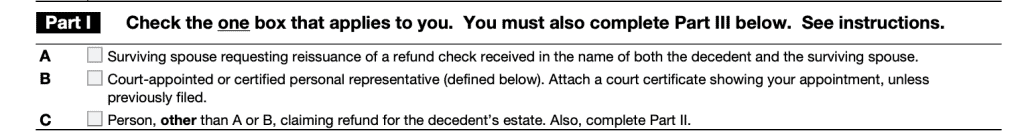

Part I is pretty straightforward. You will only check one box in Part I:

Let’s take a closer look at each one in depth.

Check the box in Line A if you:

This might be necessary if you filed a tax return together, received a refund check in both your names, but you cannot deposit the check.

If you check this box, you can return the joint-name check by writing “VOID” across the front. Send this check, along with the completed form to your local IRS office or the Internal Revenue Service Center where you filed your return. You’ll also have to send a written request for reissuance of the refund check.

Once the IRS receives this, they will issue a new check in your name and mail it to your address.

If you check the box in Line A, you can skip Part II and sign Part III below.

Check the box in Line B if you are a court-appointed or certified personal representative claiming a refund on either:

If you check Line B, you will need to attach a copy of the court document showing your appointment. If you’ve previously filed paperwork with this certificate attached, you do not need to do this again. Instead, you’ll complete Form 1310 and write “Certificate Previously Filed” at the bottom of the form.

If you check the box in Line B, you can skip Part II and sign Part III below.

According to the instructions, the IRS considers a personal representative to be the executor or administrator of the estate for the deceased individual, as recognized or appointed by the court.

The IRS specifically disallows a copy of the decedent’s will as proof that someone is a personal representative.

Check the box in Line C if you have to fill out the form, but neither of these situations apply to you. If you select Line C, you must accompany the Form 1310 with proof of death.

Proof of death can be either of the following:

If you select option C, you’ll need to complete Part II before signing Part III below.

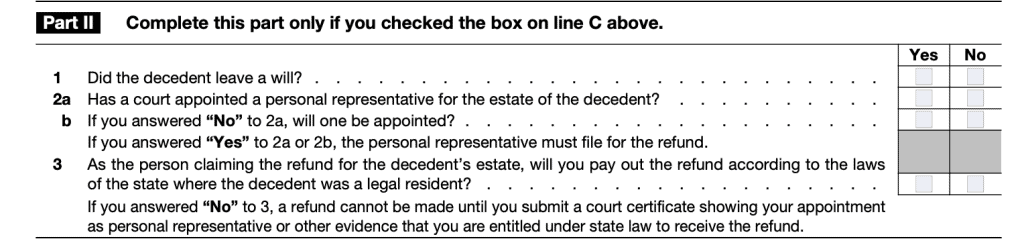

This section is required only if:

For each question below, you’ll answer Yes or No. Let’s take a closer look.

Answer Yes or No.

If Yes, then the personal representative must file for the decedent’s tax refund.

If No, go to Line 2b.

If Yes, then the personal representative must file for the decedent’s tax refund.

If No, go to Line 3.

If you answer No, then the IRS will not issue a refund until you submit either of the following:

If you affirm this, but later renege on this commitment, the federal government can hold you accountable (see Part III below).

This section is simply the signature area that affirms the accuracy of this filing. Please note, this signature is under the penalty of perjury.

So if you filled out Part II above, and you selected “Yes” to the question in Line 3, then you are binding yourself to a legal obligation.

Below are some filing considerations about how to request the decedent’s tax refund from the IRS.

Anyone who expects to receive an income tax refund on behalf of a decedent should file IRS Form 1310 if he or she is:

The IRS guidance on how to file IRS Form 1310 depends on the specific situation.

For a surviving spouse requesting a reissued refund check, you can return the joint-name check with Form 1310 to your local IRS office or the IRS Center where you filed your return.

For a claimant who, checked the box on Line B or Line C, you can either:

If the original federal return was filed electronically, mail Form 1310 to the IRS Center designated for the mailing address on the form. See the instructions for the original return to obtain the address.

According to the form instructions, you must file Form 1310 if both of the following conditions apply:

In other words, if the decedent’s refund hasn’t already been accounted for in a tax return filing after the decedent died, then an IRS Form 1310 must be filed.

To help better understand the use of Form 1310, we’ve included a couple of case studies. The first involves a situation where the taxpayer should file Form 1310, while the second walks through an example where the beneficiary does not need to file in order to claim the decedent’s unpaid tax refund.

Jane Smith is the personal representative and sole heir to her father’s estate. Her father’s accountant noticed an error in a previously filed tax return and is filing an amended tax return on behalf of Jane’s father’s estate.

As the sole heir, Jane will eventually receive the refund. However, to properly receive the money, she would follow the tax code:

Using the above example, let’s imagine that Jane’s father died before he was able to file an income tax return for the previous tax year. As his estate’s personal representative, Jane would file an income tax return on behalf of the estate.

If the income tax return shows that Jane’s father was due a refund, Jane would not need to file IRS Form 1310. Jane would simply attach a copy of the court certificate to the tax return showing that she was appointed personal representative.

Watch this instructional video to learn more about claiming a tax refund on behalf of a decedent’s estate using IRS Form 1310.

IRS Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, is the tax form that you can use to notify the Internal Revenue Service of a taxpayer’s death. If the taxpayer was owed a tax refund, IRS Form 1310 will direct the IRS where to send the refund.

Do I file IRS Form 1310 with a tax return?If filing with an amended tax return, you may attach IRS Form 1310 to the amended return. However, you do not need to attach IRS Form 1310 to a previously filed tax return or a future tax return.

Can I file Form 1310 electronically?There are certain tax preparation software programs that may be able to electronically file IRS Form 1310. However, you should discuss this with a qualified tax professional to avoid filing errors.

Who can claim a refund on behalf of a deceased taxpayer?Generally speaking, a surviving spouse or personal representative of the decedent’s estate (usually the executor) will claim the refund on behalf of the taxpayer. A personal representative or person who is not a surviving spouse must distribute the refund according to the state laws where the decedent resideded.

What if I’m a beneficiary? Can I file Form 1310 to have the tax refund forwarded to me?If you are a beneficiary who is not the surviving spouse, filing this form does not forward the refund to you directly. It simply instructs the IRS to send the check to the decedent’s estate. It is the personal representative’s responsibility to ensure the money is properly distributed according to the decedent’s wishes and the laws of the state.

You may download a copy of the IRS Form 1310 from the IRS website or by selecting the file below.